Table of Contents

Enter Re

Overview

Re, a simple two-letter word in the Latin alphabet, has several significant meanings in modern communication. It is also the second note of the major scale in solfège, serving as a tool for musical understanding and visualization. Additionally, “Re” can be used to express a new beginning or innovation in previously asserted knowledge or function.

Today, Re represents a protocol and product suite that serves as a gateway to new beginnings and innovation in the traditional finance and cryptocurrency industries.

Vision

The Re Protocol is aptly named, as it presides over all beginnings and transitions. Re serves as the protocol that unlocks a visionary pathway and enables on-chain engagements previously unknown. The untapped potential of Re is limitless and can serve as a stepping stone for native regulatory-friendly products and concepts that were never before considered. Financial disruption need not bend the knee to regulatory red tape; it can instead coincide in harmony like never before.

Re is a legal framework for the adoption of blockchain technology. By ensuring compliance with existing securities laws and regulations, the protocol can enable broader adoption of blockchain technology, while providing investors with the necessary protections and safeguards.

Re allows individual investors to self-custody their assets, self-report, and still be fully compliant with local Securities and Exchange laws, the benefits of such a protocol are significant:

- It enables the development of new order types and execution strategies that leverage the unique properties of blockchain technology. This can provide investors with greater flexibility and customization when executing trades, improving their performance and reducing their risk exposure

- It provides greater visibility into the execution of trades and the behavior of the market as a whole, by leveraging the transparency and immutability of the blockchain. This can improve the accuracy of modeling and simulation of market dynamics, which can enhance the performance of algorithmic and quantitative execution strategies

- It unlocks more efficient and secure settlement of trades, reducing operational risk and improving market efficiency. Smart contracts can be used to automate the settlement of trades, ensuring that all parties involved in the transaction receive their assets in a timely and secure manner

- It facilitates the development of decentralized exchanges (DEXs) that operate entirely on-chain. DEXs can provide a more secure, transparent, and efficient way for investors to trade assets, without the need for intermediaries or centralized exchange platforms. This can reduce costs, increase market participation, and provide greater access to liquidity for investors.

A Bridge between TradeFi and DeFi

Re allows DeFi-native products and protocols to be accessible directly to any integrated traditional firms, enabling them to operate fluidly within this growing industry. The Re protocol utilizes CosmWasm smart contracts and Inter-Blockchain Communication (IBC) to establish secure cross-chain communication and enable settlement within the native protocol of interest without custodial services and third parties. This offers a new compliant and secure pathway for firms to manage positions directly with their intended trading of the underlying asset.

With the Re protocol spearheading a new form of execution and settlement in the Cosmos ecosystem, traditional firms familiar with the FIX protocol layer can bridge over the familiarity in execution and experience directly to Re’s workflow, which mimics their standardized order flow.

The benefits of a native protocol serving as a layer for traditional exposure reaching into the Cosmos and DeFi as a whole allows incentives to be met on a range of topics from compliance and regulation to negated latency with orders, potential arbitrage incentives, and greater exposure to previously untouched DeFi protocols.

Background

The FIX Protocol and Beyond

In 1992, Robert Lamoureux and Chris Morstatt authored a release of the Financial Information eXchange (FIX) protocol. This ushered in a new standardized method for establishing communication and relaying direct insight between enabled operating financial firms, primarily at the time between broker-dealers and their respected clients.

Before the introduction of FIX, the existing methodology for settlement and direct communication was reliant solely on verbal telecommunication channels between brokers and institutions. As global innovation scaled at never before witnessed heights, along with the launch of the internet, this process became dated and introduced a myriad of malicious attack vectors and simple hangups that couldn’t keep up with demand.

By introducing the FIX protocol, there was now a vendor-neutral messaging solution that established communication for end-users participating in markets. It gave the ability to relay pre-trade communications, trade execution, and enabled a streamlined process for data aggregation for regulatory reporting and auditing. FIX introduced what is now the standardized execution management system (EMS) that nearly every major institution has adopted in the United States.

Coincidentally, just like the initial timeline of market introduction to FIX, a new wave of financial product engagement presented itself in the last decade. Decentralized finance and cryptocurrencies have taken the world by storm and caught the attention of financial entities ranging in all sizes, including the world’s general population.

Every firm, whether they are against the grandiose vision that crypto seeks or interested in coinciding with its ethos, is seeking market fits for how they can make these new financial products work for them and their client pools. The FIX community understands this and has released an innovative API for custodial centric interested parties to participate in this growing sector. Unfortunately, their vision for every major entity adopting this API workflow comes up short as it does not interact directly with the respected protocols and products it’s placing orders for.

With Re, we have seen the core concepts that FIX has ushered in the past and are taking their vision even further with the first-ever on-chain protocol that enables every party familiar with the standardized process FIX brought, and replicating that product suite and comms layer directly to the respected assets being traded within the Cosmos ecosystem.

With FIX, the previous engagement for token settlement relied on end-users interacting within an EMS, which would communicate with third-party liquidity providers and custodial market participants, diluting trade execution workflows and depending on execution intention, less favorable return. By introducing a native “EMS” protocol interacting with the Cosmos ecosystem, the enablement of a myriad of untapped market potential and negating previous latency metrics in the trading order flow allows participants to interact within a financial market unlike ever before. Higher arbitrage returns versus centralized custodial players, direct communication with the protocol negating 3rd party order fees, and base layer benefits are just the start for what Re enables versus the previous traditional method in utilizing the FIX API and similar products.

At a protocol level, Re alone ushers in a new form of communication that enables execution unlike anything before. Taking it further, Re enables native indexing, native options mechanics, and so much more. All within a regulatory-enabled framework that allows any market participant to engage with.

Use Cases

Unlocking New Incentives with Re

On-chain messaging layers enable seamless communication for executing orders and communicating from the client front end to the assets direct protocol layer. This minimizes latency and improves capital efficiency upon deployment. Moreover, it negates the need for enterprise exposure to engage with custodial services, as it provides a regulatory-compliant workflow that directly engages with end users for deeper liquidity pools and higher arbitrage opportunities within the Cosmos ecosystem. This is unlike FIX’s current exchange API methodology, which is limited to only custodial exchange order logs.

Re enables adoption and exposure at scale for the Cosmos ecosystem, unlike ever before. This ecosystem, known as “The Internet of Blockchains,” is further enabled by the world’s first institutional pathway for native, on-chain engagement.

The Foundations Realigned

On March 17, 2010, Bitcoinmarket, the first cryptocurrency exchange, went live globally with no true consensus on unit price. BTC started trading at an exchange rate of 333 BTC / 1 USD. The now-defunct Bitcoinmarket served as the initial step for a global phenomenon and financial market disruptor for what would be known in the future as decentralized finance, “DeFi.”

By enabling permission-less and decentralized financial market engagement across the globe, Bitcoin and Bitcoinmarket sparked interest from traditional trading firms of all sizes. These firms have become more engaged and eager to find new ways to stay ahead of the ever-changing curve that this newfound industry brings to fruition.

Currently, the industry standard for institutional firms or all sizes trading cryptocurrencies is to use FIX protocol’s crypto-oriented API, or a variation of such with HitBTC’s API integration (which entails using FIX’s 5.0 release). Although FIX’s solution and similar competing products deliver a sound and very competent solution for their client base trying to tap into this growing market segment, the team behind Re believes that competence and sound product aren’t metrics safe from disruption, especially in our industry that is ripe with innovation at every turn.

Utilizing a variation of the FIX protocol API within a front-end and engaging with various financial product suites through custodial provisions does not suffice for an “ends-all” to establishing communication and settlement in an industry driven by on-chain engagement and data metrics. Re understands the importance of what FIX offers and sees that their current design is missing a critical piece, being directly embedded into these respected chain ecosystems.

Behind the inception of Re lies a cypher punk altruism that enables market participants of all sizes to interact directly with their native chain economy in a non-custodial manner while playing by their respected regulatory requirements within an EMS (execution management system). This allows for a more intimate and profitable engagement, unlike ever before, all while not straying away from pre-existing workflows that FIX offered in their repertoire.

Technology

Understanding Cosmos

Since inception, Cosmos has served as the pinnacle example for establishing a protocol vision that brings a distributed, developer friendly ecosystem and enabling cross blockchain communication with it’s IBC release (Inter-Blockchain Communication) still to date serves as the only true instance to do so natively. In building out a protocol in aspirations of serving as the pillar for traditional finance entities to operate efficiently within cryptocurrency markets and establish a direct pathway to communicate with these said cryptocurrencies such as Re coincides with the grander vision the Cosmos community has been known for. Along with the FIX Protocol architecture, the Cosmos SDK shares similar characteristics that can enable Re’s deployment efficiently without throwing many exotic variables into play. Considering ease of design and years of extensive experience within building in the Cosmos ecosystem the fit couldn’t have played out any better for consideration on where to build the foundation of Re.

Product Ambitions

With the launch of Re the product suite it enables is limitless as far as what tooling traditional entities can utilize in trading operations:

- Simplified front end that allows complete and regulatory compliant interactions within the Cosmos ecosystem that’s replicated to pre-existing familiarities with the FIX Protocol

- Innovative trading strategies in concept replicating a Cosmos index, in short basket trading natively on-chain allowing greater arbitrage and returns on execution versus similar custodial products

- Options vault utilizing basic execution on CosmWasm smart contracts for various Cosmos chains allowing a lesser volatile product to be exposed to traditional entities who want exposure

- Future EVM compatibility to enable the Re Protocol vision beyond the Cosmos

Protocol Design

Overview

Many crypto exchanges today, namely Coinbase and HitBTC, offer trading and market data APIs via REST and/or WebSockets for interacting with the existing FIX protocol. These services serve well for those who rely on trading software that uses the FIX protocol, but come short in data observability and audibility.

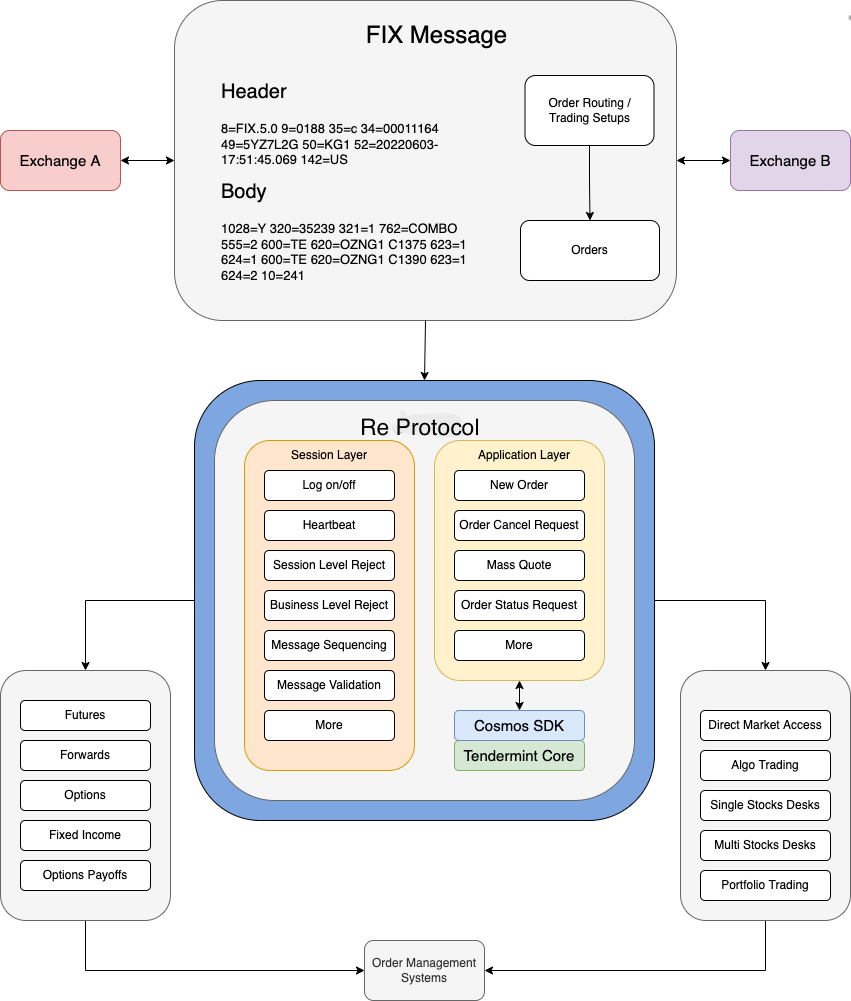

With Re we aim to reimplement the FIX 5.0 specs in the application layer with the Cosmos SDK and serve our potential customers decentralized, community-powered API’s via the gRPC, REST and Websocket interfaces which are built-in to the Cosmos SDK.

FIX on Cosmos

Similar to the Cosmos SDK, FIX also employs a modular data model for assets and parties:

- The rich support for different message types in the Cosmos SDK is well suited for FIX messages (e.g. orders and executions, market data, quoting data, and trade reporting)

- Interoperable Market Identification Code (MIC) codes as NFTs

- Decentralized Identifiers (DIDs) for different digital assets

What Re Is

- A settlement layer for on-chain security clearing

- A portal to FIX integration in distributed ledgers

- A registry for Digital Token Identifiers (DTIs)

- A framework for creating taxonomies for digital assets (i.e. a single FIX security type for all digital assets), serving as authoritative reference data in a space where asset identification is difficult amongst cryptocurrencies that can be forked and have no governing bodies

- A reporting infrastructure that’s compatible with traditional asset classes, and that can be easily adopted by regulators to monitor and track the digital asset landscape

Architecture